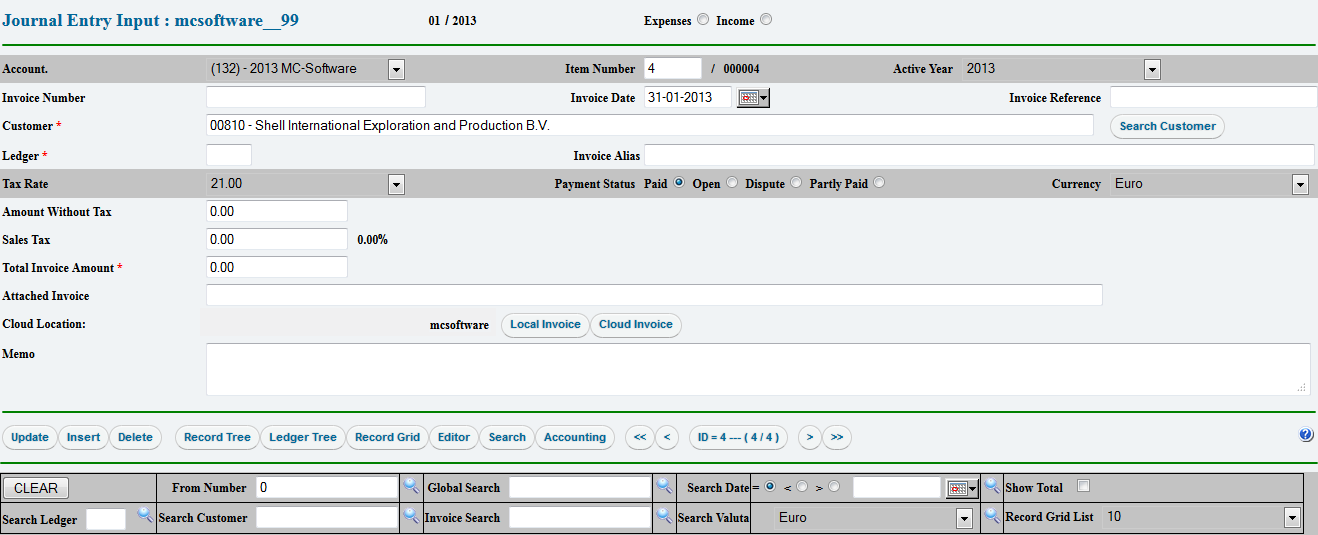

Journal Entries

How to use the MC-Invoice Journal Entry Screen

For fast field selection, the Journal Entry form uses access keys:

![]()

| • | The upper left section show the module name with the of name of the Invoice Manager |

| • | The month date label is the month and year of the current record |

| • | The Expense/Income option buttons show the type of invoice. |

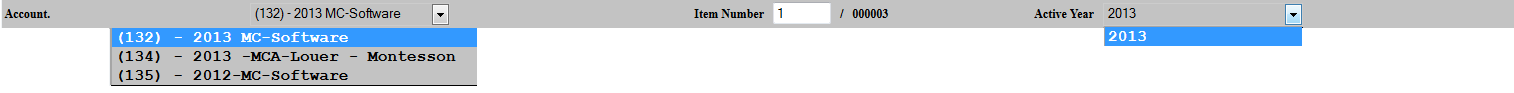

| • | The Account list box let you select the bookkeeping you want to work with. |

| • | Item number show the record number and the total number of records in the selected bookkeeping. |

| • | Active year shows the year the bookkeeping is in. Clicking on the Active Year combo box should only show 1 item in the list. If there are more items in the list, select that item or items and change the year to the year the bookkeeping if for, or delete that record |

Items whit a red asterisk sign are required. All other fields can be filled but if not, does not disturbs the correct working of the Journal Entries form.

Mandatory items that are not filled, will show an error messages when the record is saved.

| • | Invoice number can be the number on the invoice or a private numbering for this bookkeeping. |

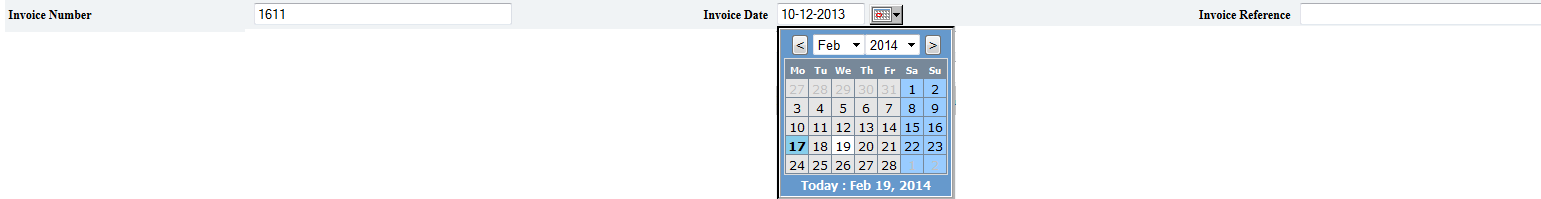

| • | Clicking on the invoice date, the Date selector pop up form will show. A date can also be filled by hand. The date format dependent on the country settings of the local computer. If a wrong date is given, MC-Invoice will change it to the next acceptable date. |

| • | Invoice reference can be used to fill any reference from the invoice. Invoices made with MC-Invoice, will automatically use the description of that invoice. |

![]()

| • | The ledger can be filled by hand or from the Ledger Tree items. If a hand filled Ledger not exists, it will be removed when the records is updated. |

| • | The Invoice Alias is a field that will be filled automatically when an image or a PDF is selected with the Local or Cloud Invoice Selection invoice selection screen. For better search facility it's better to give a human description text. The text in this field can be changed without any consequence. |

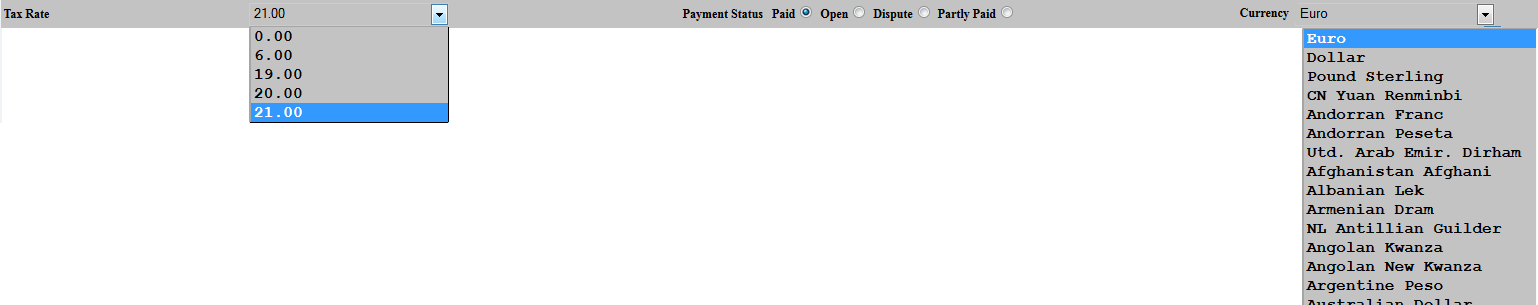

| • | Tax Rates |

All Tax Rates that are defined in the System section will be used to calculate automatic

| ▪ | the total with tax when only the amount excluding tax is given |

| ▪ | The amount without tax if only the Total Invoice Amount is given |

To make this work, there must be an tax rate selected from the Tax Rate selection combo box.

Also it is possible to overwrite the tax rate from the combo box and fill in a amount manual. The total will change based on the Amount Without Tax and the manual Sale Tax.

If the Total Invoice are changed, the Amount Without Tax will change according to Total minus Sale Tax.

| • | Payment Status |

The setting is informational only.

The status from MC-Invoice invoices will be automatically change to the invoice status when it change.

The status of Invoices from 3th party must be maintained manual.

| • | Currency |

The currency can be changed for every invoice record but make sure the amount is in the current currency.

Reports will recognize different currencies but it will culminate the totals as one currency.

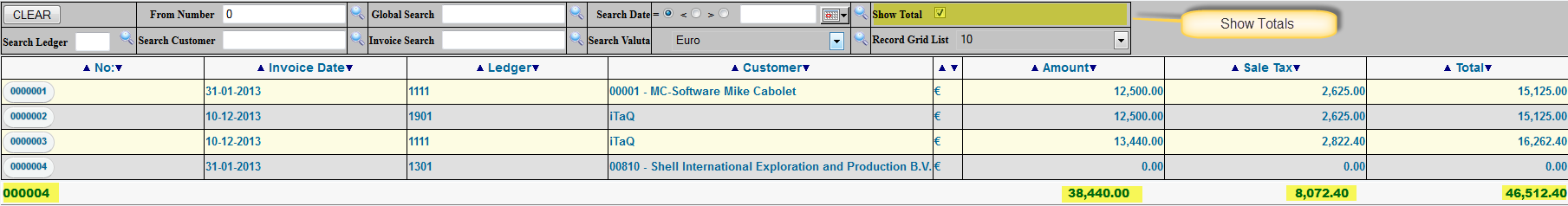

| • | Show Totals |

To show the total of the selected journal entries, click the check box "Show Total" and then click the UPDATE button.

If the check box is clicked without UPDATE, the totals will not show when a record is selected from a grid button or from a tree selection.

The server only remembers changes after an update action.